The labour of love that is Altruistic Surrogacy in Australia

Altruistic surrogacy is legal in Australia and so is paying the premiums for a Surrogates' Life and Disability insurance policies.

Who’s using Surrogacy in Australia?

For many Australians, having children and raising a family is a natural and important part of their lives. But for some people, this dream doesn't come easily and when other avenues have been exhausted, options for surrogacy are considered.

- The intended parents, (sometimes referred to as commissioning parents), are the parents of a child born through surrogacy.

- A surrogate is a woman who carries a baby for a couple or individual who cannot conceive naturally on their own.

Different types of surrogacy

Gestational Surrogacy (as opposed to Traditional Surrogacy) uses a form of assisted reproductive technology (ART) where a woman (the surrogate) offers to carry a baby through pregnancy on behalf of another — a person or couple, same-sex or heterosexual — and then returns the baby to the intended parent(s) once it’s born.

The gestational surrogate has no genetic link to the child she carries as her eggs cannot be used to conceive the child.

Traditionally, surrogacy was one way only heterosexual couples, who had difficulty falling pregnant or who were unable to carry a pregnancy safely, could have a child of their own.

Now a growing number of single parents and same-sex couples looking to start their own families are looking to use Surrogacy.

What's our part in this journey?

We're all about protecting both the intended parents and their surrogates from the major insurable risks of life and unexpected disability.

We're all about protecting both the intended parents and their surrogates from the major insurable risks of life and unexpected disability.

We specialise in helping;

- intended parents get the highest quality life insurances in place for themselves, and help them

- arrange life and disability insurances for their surrogate

in a respectful and confidential way, with a minimum of paperwork and no need for a face-to-face meeting.

Life and Disability Insurances for your surrogate should be established well before any medical assessment or attempts to become pregnant.

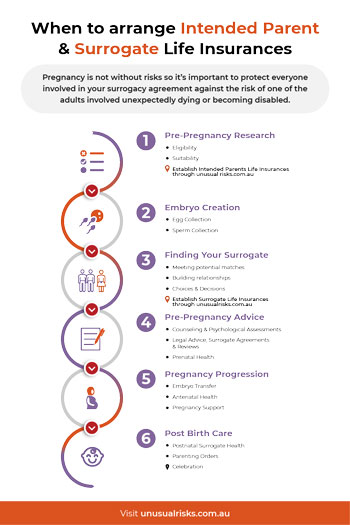

Download our Insurance Timeline Chart

Learn more about the IVF & Insurance Timeline to arrange Life Insurances for Intended Parents and their Surrogate. Download our free resource, When to Arrange Intended Parent and Surrogate Life Insurances, chart.

We understand not everyone understands

If you're an intended parent and partway through the roller coaster that can be Altruistic Surrogacy in Australia, you may have already spent what feels like a small fortune on medical and legal costs.

We also understand you may even have had to battle a level of ignorance and stigma from the un-informed portion of the community, or even extended family.

- The team behind Unusual Risks Insured respects your need for privacy and completes all our work under the brand name of our parent financial advice company, Sapience Financial a financial advice brand that provides a wide range of different financial services Australia-wide.

The uncomfortable truth and what you can do about it

Although it may not be the most pleasant thing to think about, it's true pregnancy is not without risks.

- From early pregnancy until some weeks after delivery, the statistical reality is pregnant women have an increased risk of mortality compared with women who are not pregnant.

This is why Unusual Risks Insured provides comprehensive life insurance and disability protection for intended parents and their surrogates.

Critical steps in keeping everyone safe

Family Protection planning involves;

- understanding the statistical realities of life, and

- the critical role Life Insurances and Estate Planning documents (like Wills and Powers of Attorney) all contribute to building a safety net under your family's future.

We can help you with all of these critical steps.

It is important to protect everyone involved in a surrogacy arrangement against the risk of one of the adults involved unexpectedly dying or unexpectedly becoming long-term disabled?

The intended parents should;

- Arrange and pay for life insurances for their surrogate, to make sure her family is financially protected if anything happens to her as a result of the pregnancy, and

- Arrange and pay for life insurances for themselves and their future family

- Include their future child in their current Estate Planning by nominating potential Guardians and providing the protection of a backup inheritance from a life insurance policy in case one or both parents were to unexpectedly pass away before their child turns 21.

The Good News

We can help you with these critical steps in your surrogate journey.

We understand the complex process (and an array of emotions) that can be part of the surrogacy journey, so we create solutions to fix potential problems before they ever arise so you can have more time and emotional space to enjoy the journey you’re on together.

Who we work with?

We work with intended parents who are;

- ready to get their own life insurances sorted, and

- ready to protect their Surrogate with the highest quality life insurances, too.

To protect one without the other puts everyone at risk

Australian Law

Laws relating to surrogacy are managed independently by different Australian states and territories. Altruistic Surrogacy is legal in Australia as is paying for a Surrogates's life insurance and disability insurance policy premiums.

- In an Altruistic Surrogacy agreement, a surrogate doesn’t receive any payment or reward for acting as a surrogate, outside reimbursement of the surrogate’s reasonable costs incurred associated with the pregnancy.

Law in NSW

In NSW, the Surrogacy Act 2010 recognises certain surrogacy agreements, prohibits commercial agreements and clarifies the status of children born via surrogacy.

Section 7(3) of the Act outlines what is considered the surrogate's reasonable costs associated with the pregnancy or birth as;

(a) any reasonable medical costs associated with the pregnancy or birth (both prenatal and post-natal),

(b) any reasonable travel or accommodation costs associated with the pregnancy or birth,

(c) any premium paid for health, disability or life insurance that would not have been obtained by the birth mother, had the surrogacy arrangement not been entered into...

Law in other States & Territories

- In VIC, the Assisted Reproductive Regulations 2019 has similar provisions.

- In QLD, the Surrogacy Act 2010 (Qld) has similar provisions

- In WA, the Surrogacy Act 2008 (and associated Regulations, Directions and Rules) has similar provisions

- In SA, the Surrogacy Bill 2019 has been introduced with similar provisions.

- In Tasmania, the Surrogacy Act 2012 (Tas) has similar provisions

- In ACT, the Parentage Act 2004 (ACT), has similar provisions

- In Northern Territory, they have released a discussion paper to create clarity on the NT position on surrogacy issues

Benefit from our professional privacy and expertise

We understand for intended parents, knowing how and who should best arrange high-quality life insurance for their surrogate can be complicated and loaded with privacy and practical personal concerns.

For over 20 years, the Financial Advisers at Unusual Risk Insured have watched Australian legislation lag behind the needs and demands of the community and how insurance companies have tried to quietly avoid this type of client; so were decided to be the change we wanted to see in our community.

All life insurance policies vary from company to company, as do their policy features and conditions.

- Sadly, the attitude of many insurance companies towards what are usually short term policies, are often less than welcoming

- Some life insurance companies deliberately tilt their policy wording towards people having pregnancy inside families, rather than outside.

As the awareness of Surrogacy increases, some insurance companies have started writing policies that only cover a pregnancy within the family, not a surrogate pregnancy.

Why work with us?

Whether you’re an intended parent or prospective surrogate, it's important you work with a specialist financial adviser who understands both;

- the technical nuances of getting the right policy cover for you, and

- who respects the deeply human connection involved when a person decides to be part of a surrogacy journey.

How to work with us

Our fee-for-service advice model allows us to provide Intended Parents with the highest quality insurance for their Surrogate, at a wholesale price - something simply not available through traditional sources.

Additional value for a Surrogate

After the pregnancy, a Surrogate also has the option to simply take over the insurance policy (and keep its wholesale price structure) - potentially saving them thousands of dollars off the standard premium rates over the length of a life insurance policy.

If you're looking for additional online resources?

Make sure you're aware of these recourses:

- for Same-sex individuals and couples: Rainbow Families

- for Blended families, single-parent and same-sex couples: Raising Children Network

- for Single Dads: Support for Fathers

- for Single Mums: National Council of Single Mothers and their Children

Where to Now?

Continue your IVF Journey…

- Make sure you Browse through our Blog

- Have questions? See our Frequently Asked Questions

- Discover someone with a similar situation in our list of Case Studies

- Get in touch through Email or jump the queue and Call for a Chat