Learn more about Lisa & Sandra in our Case Study here Lisa, corporate warrior and home provider.

- Read video transcript below.

Video Transcript:

Speaker: Drew Browne, Specialist Financial Adviser @unusualrisks

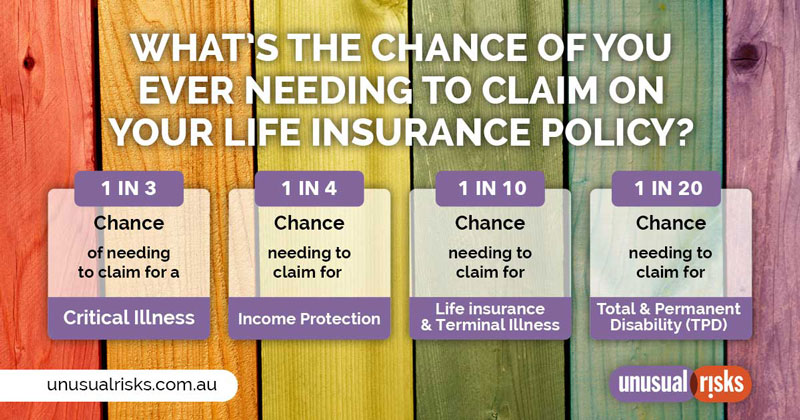

Transcript: The answer to the question everyone wants to know is, 'What's the likelihood of ever needing to claim upon a life insurance policy?' Well, the reality is the words 'life insurances' (note the plural) relates to four (4) different types of policies and the statistics of when you need to claim is different for each one.

For example, a Life Insurance policy is designed to pay out if you unexpectedly pass away. Now good quality policies also pay out if you become terminally ill. And you may not know that over 30 percent of life insurance policy payouts, are for people who find themselves terminally ill.

- The chance of you needing to claim on a Life Insurance policy is one in ten.

Now when we look at a different type of insurance which is also called life insurances, it's Income Protection. An Income Protection policy is designed to pay up to around 75 percent of your standard income in case you're sick or injured and cannot work.

- Now the statistics of you needing to claim upon an Income Protection policy before you turn 65 is actually one in four.

Another type of important life insurance policy is called Disability Insurance. Disability Insurance is also known as (TPD) or Total and Permanent Disability this is something that can pay you a lump sum of money, if you become long-term disabled and likely never to be able to return to your type of employment again.

- The statistics of you needing to claim on a TPD policy is one in twenty.

Another important type of policy is called Critical Illness, otherwise known as Trauma Insurance or Recovery insurance. This type of policy is designed to pay you a lump sum of money if you suffer one of the listed medical crises in the policy. Now, this can be for a Heart Attack, a Stroke, a Major Head Injury Alzheimer's, Melanomas - those types of things are actually quite expensive and often require additional funds to recover.

- The statistics of you needing to claim on a Crisis Insurance policy is one in three.

So the question is, which insurance policy do you need? And the answer is, it depends on what you want to use it for. If you're a young single person and you have no dependents, you have no elderly parents, and you have no debt Income Protection alone might, be worth considering. But if you're starting to partner up, if you have children, or perhaps you have elderly parents, you may need to consider Life Insurance as well so that should the unexpected occur and you pass away, there is a block of money to help compensate those people you leave behind.

Either way, this is why you need an insurance professional to help you navigate through the process of life insurances and finding out what you can do if life never quite works out, the way you planned.

Video Links

What is the chance of needing to claim on a life insurance policy?

Where to Now?

The next steps…

- Make sure you Browse through our Blog

- Have questions? See our Frequently Asked Questions

- Discover someone with a similar situation in our list of Case Studies

- When you're ready to know if we can work with you, take our Anonymous Pre-assessment

- Or Jump the queue and Call for a Chat