- Read the video transcript below.

Video Transcript:

Speaker: Drew Browne, Specialist Financial Adviser @unusualrisks

Transcript: A really important question people ask is, when should they use a life insurance policy to help them manage the risks of life that they can't manage themselves? Really it comes down to the four different ways we see risk. In life, we see risks as either Avoidable, Acceptable, Manageable or Transferable.

Now everyone knows that if you can avoid a problem it's a good idea to do.

Living life is risky and the older you get the more you know that life never really works out just the way you thought you planned it would. And the reality is we all have risks to avoid, we also have risks that we have to accept that we can do nothing about but the really important risks we have to manage.

Now managing a risk requires a different approach. It might be that you have to tell the kids to 'stop running around the swimming pool.' You might have to enforce the rule that they should stop tormenting the neighbor's dog.

It also means that you might have to use an insurance policy - so that if your son drives the family car through the Mercedes-Benz showroom - that you have a policy in place to protect you from the catastrophic financial effects that such an accident can occur.

And that's about managing risk, but there are some risks that are so catastrophic that are so significant and life-changing, that we have to transfer them away to an insurance company to hold for us. That's where a life insurance policy comes in; if you unexpectedly pass away before your time, your plans your mortgages your debts, your hopes for your children's future can continue and the catastrophic effect of that financial loss doesn't have to be borne by them.

Another way you can transfer a risk that's too great to hold personally, to an insurance company, is through Income Protection. An Income Protection policy can pay you if you're sick or you're injured and you can't continue in your job until you recover. It's important when you're looking at ways to manage the risks for your family and yourself that you consider that the major risks should be transferred to a major insurance company to hold for you.

Life is risky that's just the reality of it, and the issue may not be whether or not you can afford the premium, the real issue is maybe you don't think these things might happen to you.

Video Links

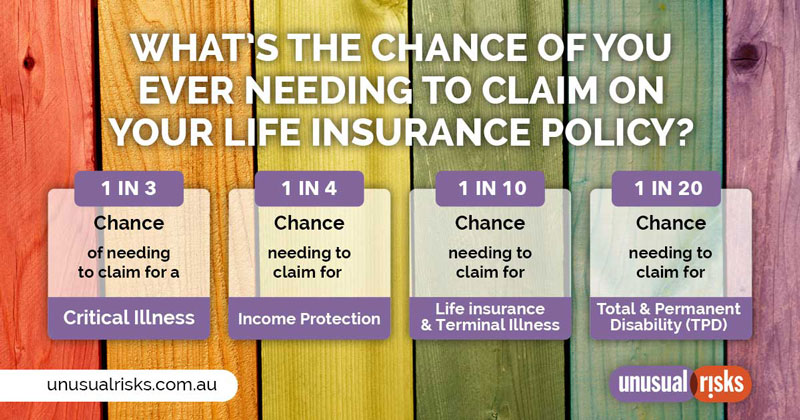

What is the chance of needing to claim on a life insurance policy?

Where to Now?

The next steps…

- Make sure you Browse through our Blog

- Have questions? See our Frequently Asked Questions

- Discover someone with a similar situation in our list of Case Studies

- When you're ready to know if we can work with you, take our Anonymous Pre-assessment

- Or Jump the queue and Call for a Chat