- Read the video transcript below.

Video Transcript:

Speaker: Drew Browne, Specialist Financial Adviser @unusualrisks

Transcript: There are four possible outcomes for any life insurance policy.

Number one - it can be accepted at Standard Rates - now this means that the price that was quoted in the premium is the price you'll pay, the standard price.

The second outcome is where premiums are Loaded with a medical rating that might be because of a medical situation or an occupational situation where the risks have to be managed.

The third outcome is that a policy can be Delayed from finishing because we haven't yet received the medical reports or the assessments that we require to be completed.

And of course, a policy can also be Declined. A Decline can be because a medical situation is beyond what's possible to manage or an occupational category is beyond what's covered by that insurer.

Either way, that's why you use a professional insurance advisor to help you navigate successfully through these four possible outcomes for your policy.

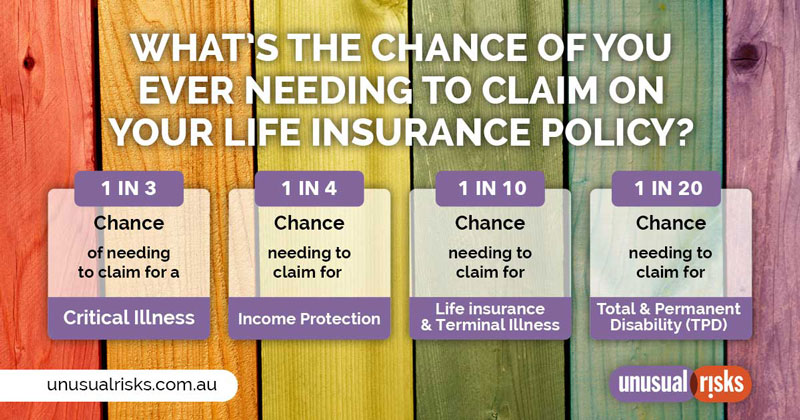

What is the chance of needing to claim on a life insurance policy?

Where to Now?

The next steps…

- Make sure you Browse through our Blog

- Have questions? See our Frequently Asked Questions

- Discover someone with a similar situation in our list of Case Studies

- When you're ready to know if we can work with you, take our Anonymous Pre-assessment

- Or Jump the queue and Call for a Chat