- Read the video transcript below.

- Learn more about George and the question, 'How Much is Enough? in our Case Study here.

Video Transcript:

Speaker: Drew Browne, Specialist Financial Adviser @unusualrisks

Transcript: How much life insurance is enough? It depends upon how much living you have to do.

Some questions in life are really hard to answer because the correct answer is different depending on who you ask.

What's right for you in your situation, might not be right for someone else in their situation. The especially tricky questions in life usually have emotional and financial consequences, like the question, 'how much life insurance is enough?'

So how much is enough?

Well, the short answer is, 'it depends upon how much living you have to do?' Making the world a better place for you and your family starts with looking after yourself, and having a plan in place to manage the normal risks of life. Managing debts, family obligations and protecting assets. So, you insure your house, probably insure your car, maybe even your iPhone for replacement value but when it comes to measuring the value of a human life - you can't it's priceless - but what he can achieve is worth protecting. One of the best ways people protect their family's financial independence is through life insurance.

Basically, life insurance replaces the income you didn't have the chance to earn by living and working and compensates your family for lost opportunities because you passed away early or unexpectedly.

If you're like most modern families, you've probably got some big and exciting plans for the future. But why should those plans be put at risk or not happen, just in case you're not there. But with a life insurance policy if you're terminally ill or pass away unexpectedly, your family or whoever you nominate, can feel safe that the amount you've chosen -perhaps hundreds of thousands of dollars, maybe even millions - will be there for them to help cushion their loss, almost immediately and usually tax-free.

So how much is enough there's no exact answer but more insurance gives you more protection. It also depends on what you can afford, so you may need to prioritize. It's often a trade-off between what you'd ideally like and what you can afford. Ultimately, it's a question that only a financial advisor can answer with clear-cut detail but until you have that conversation with the financial advisor, here's a suggestion on how to start your thinking about that tricky question.

How much is enough?

Over the years we found that most people want pretty much the same things for their family, and when we asked how much is enough they usually have the same four wishes.

We call them The Big Four Things. You'll probably call them common sense, so here they are.

- One - have enough to pay out all your debts.

- Two - have enough to replace the lifetime value of your income.

- Three - have enough to provide a nice place to live.

- Four - have enough to leave a legacy so your big plans for your family still happen, even if you're not there to share them.

Let's see how the big four things approach worked in real life. Meet George. He's a logistics coordinator who spends most of his work time chasing boxes, deadlines and freight companies His partner is the love of his life and drives him crazy at times. George has a stepdaughter who he had adores and a well-earned reputation as a bit of a weekend DIY tragic, relentlessly renovating his townhouse. George's shift work is often unpredictable, so living closer to work in cafes makes his life easier. He's on his second significant relationship and is determined to make sure this one is the best one. His superannuation balance took a hit from a past family-law-settlement, so George realizes that from now on he'll have to work a little longer and a bit smarter to make up for lost time and resources.

So today George is getting his life insurance sorted. He wants to do his part to protect and provide for his partner and his family and safeguard their long-term financial independence.

Let's look at how George approached be how much is enough question for his family.

- First, he added up all his current debts (and added five percent for inflation just to be sure) Along with the home loan, it came to around five hundred and twenty-five thousand dollars.

- Next, he calculated the value of his income until retirement. With at least a good 25 income earning years ahead of them on a wage of $83,000 a year over the next 25 years he could expect to earn at least $2,075,000.

That figure actually shocked him, because he never stopped to consider the huge value of his 'income-earning-potential. Finally he did a quick budget for their big future plans. George had always wanted to celebrate his 50th birthday on board a luxury cruise ship and later spend some time traveling around Europe, so he could better appreciate his partner's cultural history.

When George retires, he's determined to be an active super-grand-dad to his future grandkids. A tormentor to his partners-in laws and maybe spend six months or so volunteering his logistics management skills overseas, with the Red Cross. He's always trying to give back and make a difference in the world. He figured that the budget for the big future plans should be about two hundred thousand dollars altogether George added up the value of his big for things to be around $2,700,000.

Yep, that's a lot of cash but then again life is meant for the living. You only get one chance at and that's why George works so hard. So he decided that was the level of life insurance he and his budget were comfortable with.

Sure, the closer to retirement he gets and the more he earns the more likely he'll adjust that number down as he needs. But until then, if something terrible happens and George passes away unexpectedly now he feels finally relieved and happy (and kind of proud) that his plans to live a bigger life with his new family will continue, even if he's gone.

For George having his life insurance in place it's about being able to keep his promises and honor the commitments you make, even if you're no longer there.

Now whether you think life insurance is a financial decision or an emotional decision (or perhaps a bit of both) we understand that it's ultimately about luck, the future and reality. We like to say it's about keeping-good-growing.

Do you want to know more about how to calculate how much is enough for your situation, just ask us to introduce you to one of our specialist financial advisors who understands the needs of diverse families - whether logical or biological - and the financial and emotional choices that we all need to make to live a bigger life.

Until then what's the cost of your big four things?

Video Links

#LoveTakesAction

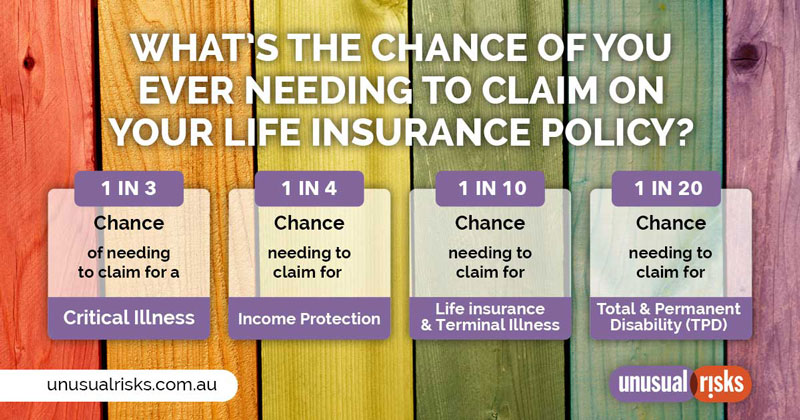

What is the chance of needing to claim on a life insurance policy?

Where to Now?

The next steps…

- Make sure you Browse through our Blog

- Have questions? See our Frequently Asked Questions

- Discover someone with a similar situation in our list of Case Studies

- When you're ready to know if we can work with you, take our Anonymous Pre-assessment

- Or Jump the queue and Call for a Chat