The complexity that can be IVF and Surrogacy Agreements.

When working through any complex process, getting the timing right is often the key to success.

And that's never more true than for folks using IVF treatments as part of Growing Families.

Jump Ahead

- Pregnancy is not without its risks

- Setting up Life Insurances for Intended Parents and their Surrogate

- When to start your insurance application process

- How to prepare for a successful Intended Parent Life Insurance application

- Finally, understand we have a process to follow too

- What happens after ‘Junior’ arrives?

Growing families with IVF is a complicated process and good timing is key.

And like all important processes, IVF cycles are designed to run on a carefully considered timeline to help ensure the best chance of a good outcome.

So where does Life Insurance come into the picture if you're considering using IVF to help grow your own family?

They say an average single IVF cycle takes about 6 to 8 weeks from consultation to transfer, depending on the specific circumstances of each recipient. The truth is, for many couples, it's anything but average and the emotional and financial rollercoaster that can be IVF, can also feel like it's kidnapped your life and routines too.

The hardest decisions are the ones with both emotional and financial consequences.

Pregnancy is not without its risks

Let's be honest. Pregnancy is not without risks.

Let's be honest. Pregnancy is not without risks.

This is why it's important to protect everyone involved in your surrogacy agreement against the risk of one of the adults involved unexpectedly dying or becoming disabled.

- From early pregnancy until some weeks after delivery, pregnant women have an increased risk of mortality compared with women who are not pregnant.

- Of course, this increased risk also affects the surrogate's own family and support network too, so looking after all the adults in a surrogacy agreement is vital.

This is in part why surrogacy agreements require Life Insurance and Disability Insurances to be in place to protect the surrogate with a life insurance policy.

Your surrogate will want to know that you're equally committed to their surrogacy plans.

Setting up Life Insurances for Intended Parents and their Surrogate

The question is not if, but when.

Below are some practical steps you can take to help to smooth out the process of setting up Intended Parent Life Insurances and Surrogates Life Insurances.

Why getting life insurances for a surrogate can be unusually difficult

Unlike general health insurance, it's important to realise an offer of life insurance is just that, an ‘offer’, not an entitlement to be covered.

- Life insurance companies design a life insurance policy to be held for the medium to long term, so offering a very short-term policy is both unprofitable and not the business they want.

- This can create a problem when a surrogacy agreement legally requires life insurances to be in place to protect the surrogate.

Simply put, it's important to understand most life insurance companies would like not to injure surrogates — so this is why you need to work with the team behind Unusual Risks Insured who specialise in working with hard-to-insure occupations, unusual situations and health conditions.

We’re legally required to work in your best interests, and we have a solution to this problem and a process timeline to follow.

When to start your insurance application process

We work with couples and people growing their families through IVF and have created an IVF & Insurance Timeline, for you to download.

Download our free eGuide:

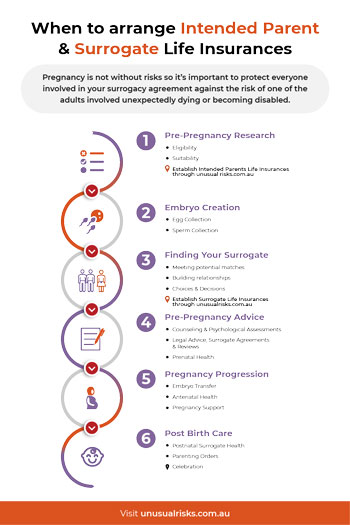

When to arrange Intended Parent and IVF Surrogate Life Insurances chart

{osdownloads download_button 1-of-the-file "Download | Intended Parent & IVF Insurance Chart"}

- For Intended Parents, we recommend they establish their own life insurances during the Pre-Pregnancy Research stage.

- For Surrogates, we recommend life insurance be established during the Finding Your Surrogate stage - after Embryo Creation but well before the Pre-Pregnancy Advice stage of legal, psychological and surrogacy agreement drafting begins.

Pro Tip: One of the key reasons we recommend starting the surrogate's life insurance application at this stage is to avoid getting stuck in chasing new medical test results. Waiting for multiple scheduled test results during pregnancy can significantly add to the time required to complete an underwriting assessment for a surrogate. This can be particularly difficult for a person with a family history of gestational diabetes, so start the process before the IVF medical process begins.

How to prepare for a successful Intended Parent Life Insurance application

- Where possible register your interest with us at least 30 days in advance, that you're preparing for IVF or Surrogacy, and what your anticipated key dates are.

- Check your own medical history to confirm you and any partners don’t have any uncompleted medical referrals outstanding. For example: if you were referred for a blood test, a possible skin cancer assessment, or an ECG, make sure you have completed all personal medical referrals.

- A life insurance underwriter will want to know if any current medical conditions are being actively managed and if any referrals for additional medical tests have been completed. Chasing uncompleted requests for additional medical follow-ups and referrals is the number one reason for a delay in a life insurance application.

- When we begin the advice assessment process, be prepared to answer these types of questions ahead of time:

- Are you a non-smoker or a smoker?

- What's your date of birth?

- Are you an Australian resident or here on a Visa?

- Are you single or partnered?

- Are you renting or repaying a mortgage and what is that approximate cost per month?

- What type of work do you do? and

- What's your approximate level of income per year?

- Do you have any existing health conditions we need to take into account?

- Do you have children or elderly parents (or someone else) who is financially dependent upon you?

- Do you have your Will in place yet and do you have your superannuation beneficiary nomination already in place?

- Have you ever been refused insurance cover in the past?

Finally, understand we have a process to follow too

We have a legally mandated information collection process to work through and we have a separate progress tracker, so you can know wherever you are in our advice process.

- Read about our 7 Step Information Collection Process

- Watch our client information video Setting Up Life Insurances

What happens after ‘Junior’ arrives?

The arrival of a new family member is always very exciting, but perhaps a little more so for our clients who are Growing Families through IVF and or Surrogacy.

While we expect that your surrogate's insurance cover will extend past the court parenting orders date and then simply not be renewed, we are more than happy to let your surrogate keep this wholesale life insurance policy and simply take over the payments if they wish, as our way of saying thank you to them.

Either way, we hope our Intended Parents will continue on with us as their new family's risk insurance advisor going into their future with a new peace of mind that ‘secure people really do live bigger lives'.